Do I care about my credit score? If I listen to Dave Ramsey, my “credit score doesn’t matter because I don’t need to borrow money anyway.” If I listen to Clark Howard, I get tips on what to do if there are “issues.”

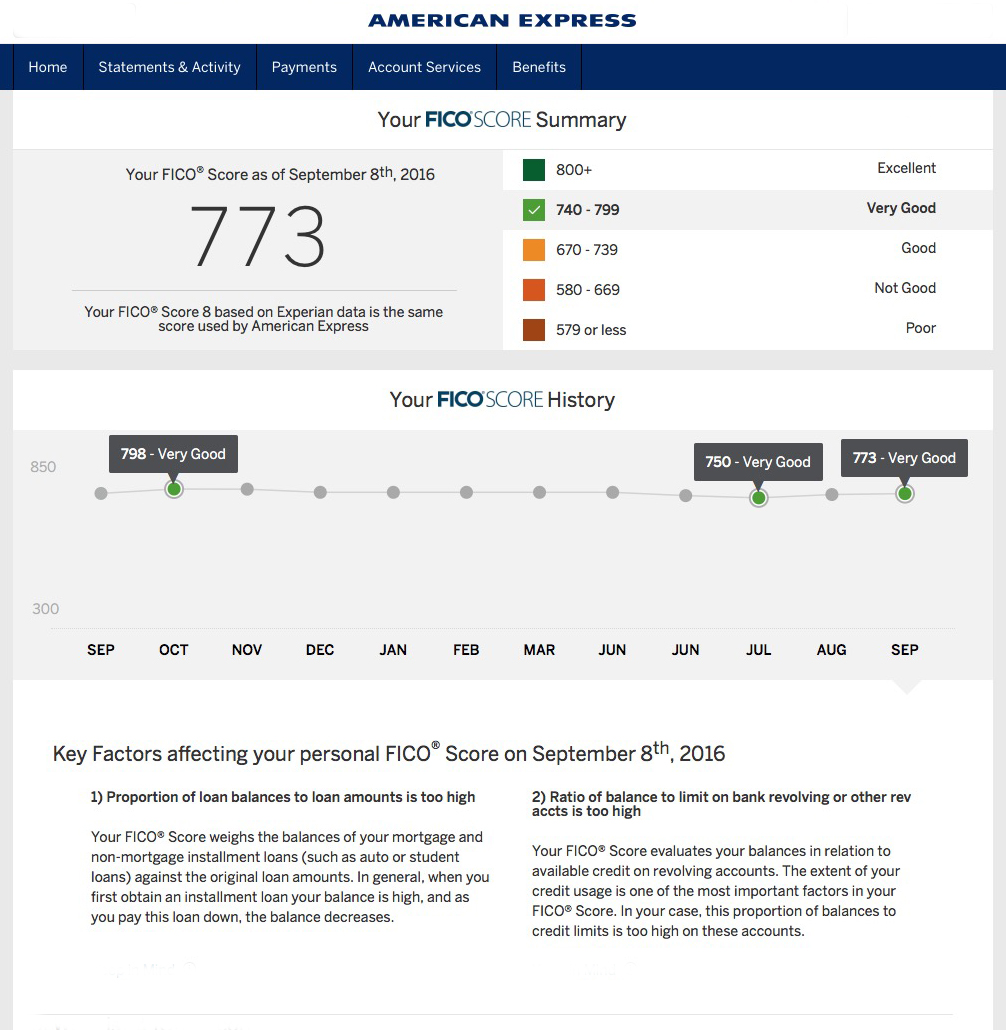

I attended a bunch of “how to survive getting out of the Army” classes a few years ago. One of the classes was about finances and included a look at my credit score. My recollection of it then was something over 800. The picture shows the current status:

I’ve had a Delta Skymiles American Express card for five years or so. A friend ran his whole business through his card and travelled frequently from the miles. I’ve bought four or five tickets now with miles, including two to Europe the summer of 2015. It adds up. Dave Ramsey doesn’t like credit cards. I’m OK with it as long as you follow Clark’s advice and pay it off in full each month.

“I’ve told my kids many times that most of the lessons my dad tried to teach me growing up I still had to figure out on my own.”

I learned several weeks ago that the AmEx card (AKA “American in Distress” card) provided the FICO score for free. I was intrigued to see that my score had been slowly drifting downward for the last year. Interestingly, AmEx/FICO even provides the reason(s). My credit worthiness (?) had been declining because 1) it had been an increasingly longer time since I had last borrowed money for anything (“12 months same as cash” for an air conditioner in 2008), and I was close to maxing out my AmEx month-after-month. Apparently they don’t care that it’s paid in full month-after-month.

I’ve decided to try a little experiment. I raised the credit limit slightly, so the utilization rate is lower. I now send an early partial payment so the average balance stays lower while paying the rest in full on time. This is super easy to do with Web Bill Pay from my credit union. Finally, I borrowed $600 from myself. Yes, really. My credit union will let me borrow money using my own cash as collateral. The finance charge on $600 for six months at 2.2% is less than $5. I thought for that little bit of “wasted money” I could have a little fun and see what happens. Again, auto payments are already in place to ensure I don’t miss anything and pay it off early.

I’ve told my kids many times that most of the lessons my dad tried to teach me growing up I still had to figure out on my own. However, the idea of paying cash for things, paying bills on time, not going crazy with cars, and saving a little bit every pay period stuck from the beginning.

About the graphic – I moused over the timeline dot at three different places and did a screen capture each time. I layered all three images in Photoshop Elements, erased parts as needed, and cleaned up various artifacts.

I’ve mentioned before there are a couple of great general saving/investing books I really like. They are linked to Amazon below as are one each I like from Dave Ramsey and Clark Howard.

PS If you happen to buy one of the books on Amazon I get a few cents on a gift card. Over the years I’ve made just enough to cover most of the costs of hosting the website. What happened to being a dot-com millionaire?